16/10/2020 – This Week in Gold

Price Movements

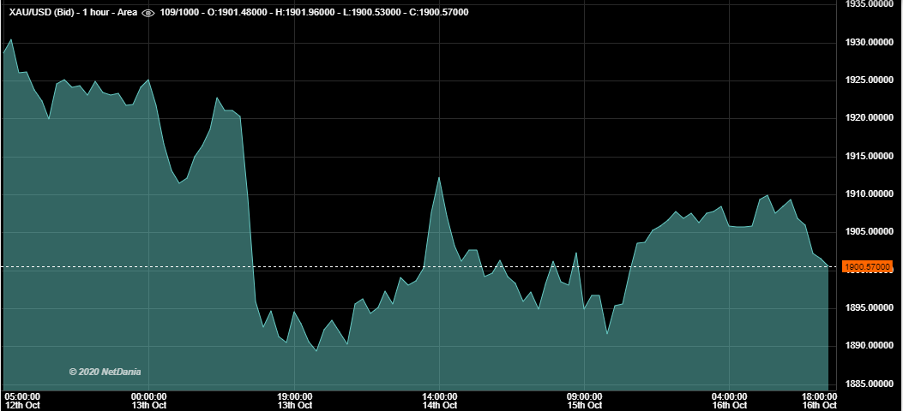

Gold started the week at $1,930 an ounce, and dipped slightly on Monday. On Tuesday afternoon gold fell sharply, losing 1.5% in a matter of hours as the dollar strengthened. The price stabilised below the $1,900 mark, before a sharp rebound on Wednesday saw the price briefly touch $1,912, which analysts linked to US Presidential election uncertainty, a weaker greenback and increasing COVID19 cases. After dipping below $1,900 on Thursday, growing concern regarding further lockdowns in Europe saw an increase in the gold price later in the week, when the price settled at $1,901.

Silver suffered a 3.5% loss during this week, eventually settling at $24.27 per ounce. The Silver:Gold price ratio increased to around 78:1 this week, higher than in recent weeks but significantly lower than the all time high of 121:1 reached in March this year.

Goldman Sachs Identify Opportunity for Silver in Solar Power

Goldman Sachs analyst Mikhail Sprogis identified a possible global surge in the demand for solar power as a major catalyst in a future bull run for silver. Sprogis believes silver will benefit substantially from a global shift towards renewable energy. This would inevitably lead to a global surge in the demand for solar energy. According to Sprogis, 18% of industrial demand and 10% of the overall demand for silver is accounted for by solar investments. This would stand to prove that a future energy shift to solar would consequently be hugely beneficial for the silver market.

US Presidential Election Uncertainty

This week JP Morgan predicted that the general uncertainty and volatility that will surrounding a win for either Trump or Biden should be beneficial for gold. However, analysts at JP Morgan have alluded to how a ‘blue wave’ for Biden and the democrats would send gold surging to new heights again this year. They have predicted a 2-5% increase in the yellow metal as a result of lower yields and a weaker US dollar on the back of fresh stimulus measures. Corporate worries surrounding higher taxes and further regulation could also add to a rush to gold. These measures could be reflected negatively on the global market as investors react, inevitably sending gold higher.