30/10/2020 – This Week in Gold

Price Movements

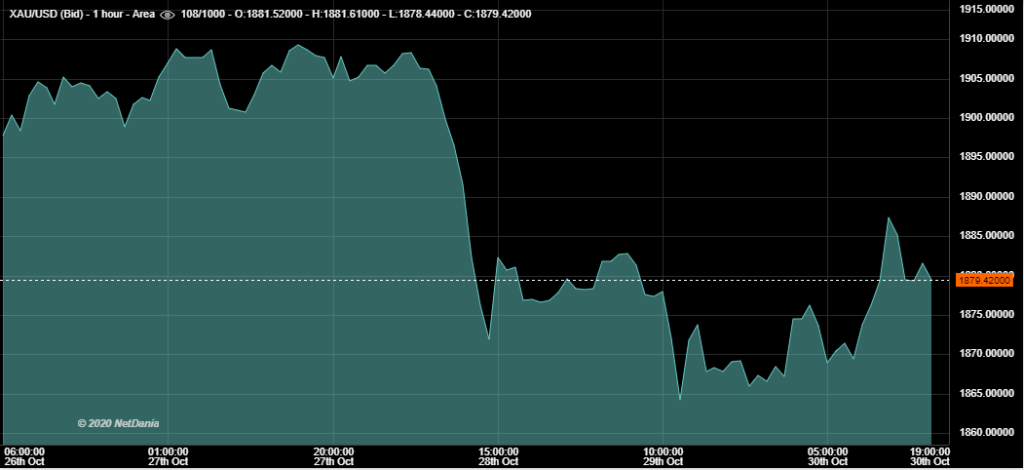

On Monday gold ticked slightly higher to rise past the $1900 mark, mainly driven by growing uncertainty as the US election draws nearer and a global spike in coronavirus cases. This continued into Tuesday, as the price bounced back off of a daily low of $1902 to $1910. On Wednesday gold dropped significantly. The yellow metal hit a three-week low as it saw a $40 decrease in price on Wednesday alone, down 1.64% for the day. Analysts cited heightened restrictions and lockdowns for many countries across the globe, mainly in Europe, as the reason for a stronger dollar and therefore a weaker gold price. The stock market and the gold price tumbled in tandem, although gold suffered less than many of the leading stock indices. This downward trend continued on Thursday as the US reported much better than expected GDP figures for Q3, growing a record 33.1%, a stark contrast from the 31.4% decline of Q2. On Friday gold endured a mixed day before ending slightly up at $1879, but down significantly for the week.

Heightened Tensions to See Gold Transfer

Relations between the US and Germany have deteriorated significantly over the last number of years due to different political and economic tensions. Because of the value gold holds as the foundation of the international financial system, it is seen as a symbol of political power between countries. Where each country stores their gold has a huge bearing on this, for example the more gold Germany stores in the US, the more leverage the US will hold over Germany as they have the power to freeze the assets. Germany began repatriating its gold from the U.S. in 2013 and as they hold the second largest gold reserve in the world, if trans-Atlantic alliances are to deteriorate further after the election, Germany many look to take back more of their gold, which could prove costly for the Fed.

Gold Price to Benefit from US Election?

As attention on the US election intensifies ever further, analysts have stated that either outcome could be beneficial for gold. Their hypothesis is based around the view there will be a low interest rate policy and increased stimulus measures introduced by either candidate should they be elected. Analysts at Haywood and UBS have outlined how the fragility of the U.S. economy met with increased quantitative easing and inflation could put pressure on the greenback and increase investment demand in gold and silver even further.