The History of Gold Investment

When The New Gold Rush Started To Happen

Gold has always been a prized precious metal, however, the history of gold investment is not long. It can be traced back to the late part of the 19th century, when many countries in Europe adopted the gold standard.

Gold standard simply refers to a system whereby the value of a country’s currency is based on the quantity of gold held in its reserves. Within this system, the dollar was directly linked to gold. But the system started to be abandoned in 1971, with the US suspending the direct conversion of the dollar to gold.

The Swiss Franc was the last currency to divorce itself from gold, with the gold standard suspended there as recently as 2000.

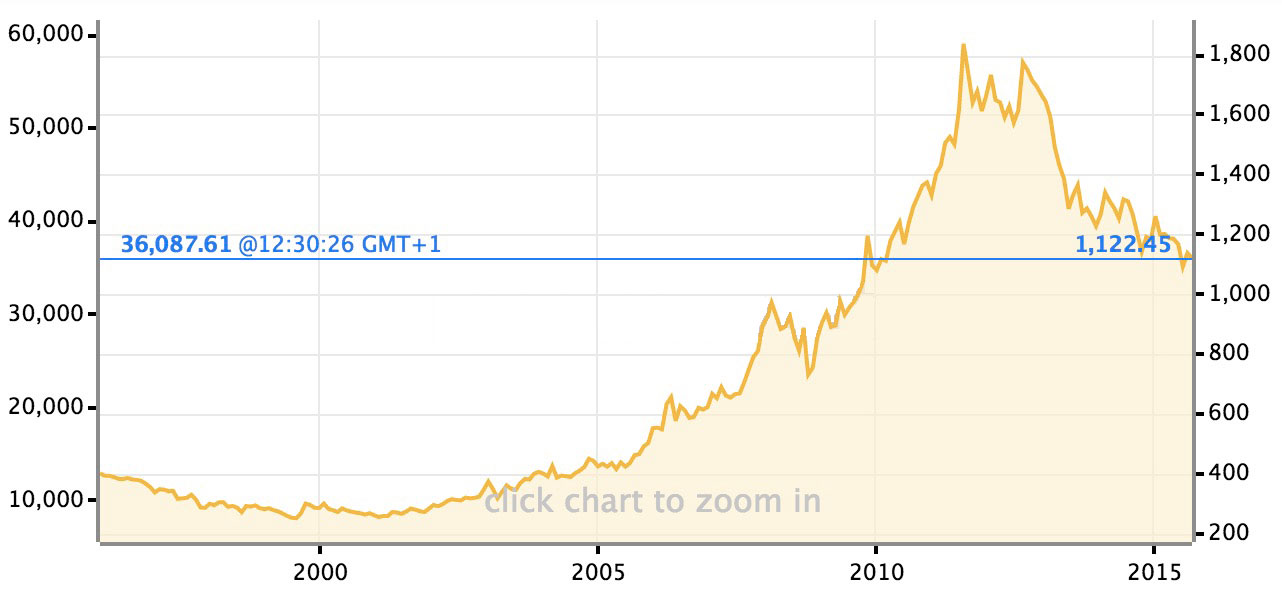

Since 1919, the price of gold was led by the London gold fixing scale, which was really just a telephone meeting of bullion trading companies in the London bullion market. Fixing its price and divorcing it from currencies combined to make gold a commodity, not a form of money, and it was only a matter of time before investors cashed in on the highs and lows of gold’s changing price.

You can buy gold in bullion form, or buy it indirectly as a futures contract investment (‘Paper gold’). But gold is not an investment per se, it is a cushion, or hedge, investment that will protect your portfolio from the volatility of other investments, like the stock market. Because it has intrinsic value and because of its industrial use along with the demand for gold jewelry, the prices of gold are relatively stable – and it’s impossible to see how this precious metal would ever have zero value, unlike stocks that go worthless when a company files for bankruptcy. Historically, whenever the stock market crashes, gold prices experience an upward rush.

As crashes tend to be cyclical it seems obvious that the value of gold will always be relevant.